All Categories

Featured

Table of Contents

A PUAR allows you to "overfund" your insurance policy right as much as line of it coming to be a Changed Endowment Agreement (MEC). When you make use of a PUAR, you rapidly boost your cash value (and your survivor benefit), therefore boosting the power of your "bank". Further, the even more money value you have, the higher your interest and returns payments from your insurance provider will certainly be.

With the increase of TikTok as an information-sharing system, economic recommendations and methods have discovered an unique method of spreading. One such approach that has been making the rounds is the limitless banking idea, or IBC for short, garnering recommendations from celebs like rap artist Waka Flocka Fire. While the approach is currently prominent, its origins map back to the 1980s when economist Nelson Nash introduced it to the world.

How does Infinite Banking For Financial Freedom create financial independence?

Within these policies, the cash money worth expands based upon a rate set by the insurance firm (Policy loan strategy). When a significant money worth gathers, insurance holders can acquire a money value financing. These finances vary from conventional ones, with life insurance policy working as collateral, meaning one might lose their insurance coverage if loaning excessively without ample money worth to sustain the insurance coverage prices

And while the appeal of these plans appears, there are innate restrictions and risks, requiring persistent money worth monitoring. The technique's legitimacy isn't black and white. For high-net-worth individuals or company owner, specifically those utilizing techniques like company-owned life insurance policy (COLI), the benefits of tax obligation breaks and substance development could be appealing.

The attraction of limitless banking does not negate its challenges: Cost: The fundamental requirement, a long-term life insurance policy plan, is costlier than its term equivalents. Qualification: Not everybody gets whole life insurance policy because of strenuous underwriting procedures that can exclude those with particular wellness or way of life problems. Complexity and threat: The complex nature of IBC, paired with its dangers, might hinder several, specifically when simpler and less risky options are readily available.

Cash Value Leveraging

Allocating around 10% of your month-to-month earnings to the policy is just not feasible for many people. Part of what you review below is merely a reiteration of what has actually already been stated above.

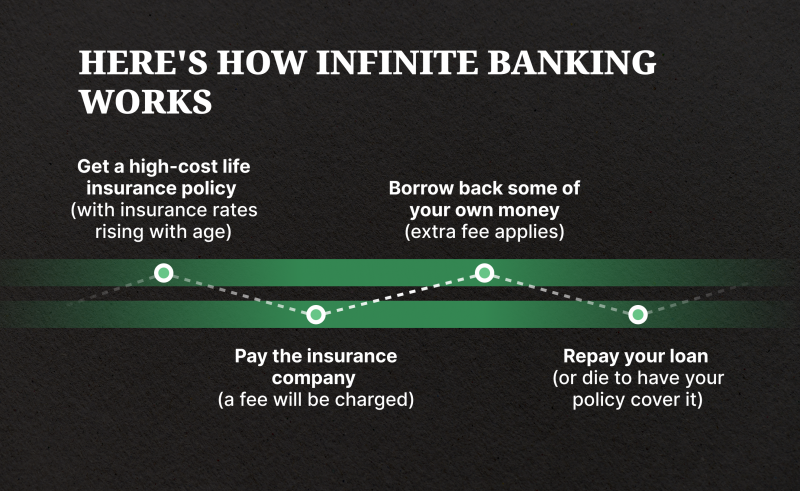

Before you obtain yourself into a circumstance you're not prepared for, know the adhering to initially: Although the concept is generally sold as such, you're not really taking a funding from yourself. If that were the instance, you would not need to repay it. Rather, you're borrowing from the insurance policy firm and need to repay it with passion.

Some social media posts suggest utilizing money worth from entire life insurance policy to pay for bank card financial obligation. The idea is that when you pay off the lending with passion, the amount will be sent out back to your financial investments. Sadly, that's not exactly how it functions. When you pay back the funding, a portion of that interest mosts likely to the insurance coverage company.

For the first a number of years, you'll be paying off the payment. This makes it exceptionally difficult for your plan to collect value during this time. Unless you can manage to pay a couple of to several hundred dollars for the next years or even more, IBC will not work for you.

How do I leverage Wealth Management With Infinite Banking to grow my wealth?

If you require life insurance policy, right here are some valuable tips to consider: Consider term life insurance. Make sure to shop around for the finest price.

Visualize never ever having to worry concerning financial institution car loans or high passion prices once again. That's the power of limitless financial life insurance coverage.

There's no set lending term, and you have the freedom to select the payment routine, which can be as leisurely as repaying the finance at the time of fatality. Infinite Banking. This flexibility encompasses the maintenance of the finances, where you can opt for interest-only repayments, maintaining the loan balance level and manageable

Holding cash in an IUL repaired account being attributed rate of interest can commonly be much better than holding the cash on deposit at a bank.: You have actually always desired for opening your very own bakery. You can obtain from your IUL plan to cover the initial costs of renting an area, purchasing devices, and working with staff.

What happens if I stop using Financial Independence Through Infinite Banking?

Personal loans can be acquired from conventional financial institutions and credit unions. Obtaining money on a credit history card is usually very pricey with annual percentage rates of rate of interest (APR) typically reaching 20% to 30% or even more a year.

Latest Posts

Banking On Yourself

Infinite Banking Strategy: Build Your Personal Bank

Bank On Yourself Complaints